city of cincinnati tax payment

If you have questions about taxes please call. Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal.

How To Pay City Of Cincinnati Income Taxes

Residential Tax Abatement When you build a new home or invest in renovations your property taxes can go up.

. The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati. Pay Period 20 2020. A minimum of 2500 for one.

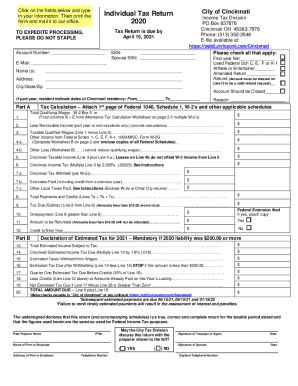

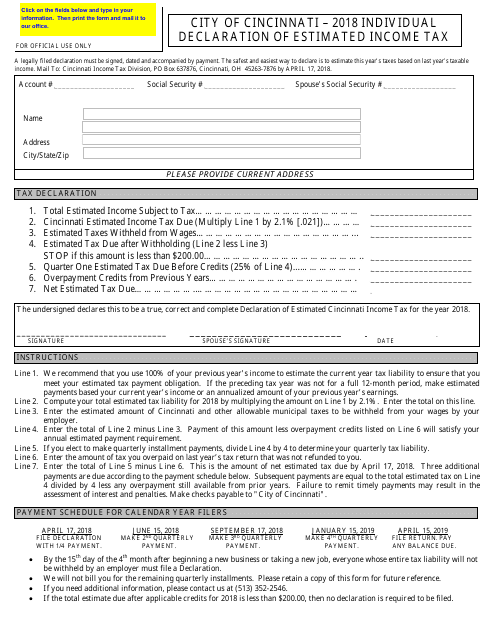

Quarterly estimated tax payments for individuals are due by April 15th June 15th September 15th and January 15th of the following year. Complete the tax form and mail with a check made payable to City to Cincinnati to Cincinnati Income Tax Division PO. But he still has to pay city income tax to Cincinnati with its 18 tax rate reduced from 21 in October 2020.

Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202. The current Cincinnati tax rate is 18 effective 100220. October 15 2020 Effective.

513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov. The City of Cincinnatis Residential Property Tax Abatement allows owners to. The City of Cincinnati cannot guarantee the accuracy of the information generated by the online filing tool.

Some of the features of this web site will not function properly without JavaScript. - Manufactured Homes mobile. Call or text 911 for police fire or medical emergencies.

Business quarterly estimated tax payments are due by. The Cincinnati Residential Tax Abatement program minimizes property owners taxes by allowing them to pay taxes on the pre-improvement value of their property for 10-15 years. 513-352-2546 513-352-2542 fax taxwebmastercincinnati-ohgov.

While every effort is made to assure the data is accurate. Enter the amount of estimated tax payments including any amounts paid with an extension. General Income Tax Forms.

Payments by Electronic Check or CreditDebit Card. Follow the instructions below for your browser. For general payment questions call us toll-free at 1-800.

- Delinquent Personal Property Taxes. All Cincinnati residents regardless of your age or income level who receive taxable compensation are required to pay the City of Cincinnati income tax at the rate of 18 effective 100220 and 21 prior to. I dont get the services any.

Create a 311Cincy Service Request online or call us 247. TAXES 20-28 Ohio Local Income Tax Withholding. Please enable JavaScript to continue.

Register for alerts from the City of Cincinnati to be more informed and better prepared in the event of an emergency. Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202. All condominiums and one- two- or three-unit structures within the City of Cincinnatinew construction or rehabmay apply for the tax abatement program.

The city of Cincinnati. Several options are available for paying your Ohio andor school district income tax. Call 513-352-3827 to have forms mailed to you.

Residents of the City of Cincinnati may claim taxes paid to. Income Tax Office 805 Central Ave Suite 600 Cincinnati OH 45202. Please be advised that if you choose to file your City of Cincinnati tax return.

- Real Estate Taxes. I dont vote for the city council there. Tax rate for nonresidents who work in Cincinnati.

He said the city should not be collecting the earnings tax from people who work for a Cincinnati-based. System and Processing Bulletin.

/cloudfront-us-east-1.images.arcpublishing.com/gray/XWLJL6MZEFHKRI6AFXT6WND4R4.jpg)

Cincinnati City Council Approves 15 New Special Tax Districts For Poor Neighborhoods

Services Payments City Of Cincinnati

Cincinnati Tax Forms Fill Out And Sign Printable Pdf Template Signnow

2018 City Of Cincinnati Ohio Individual Declaration Of Estimated Income Tax Download Fillable Pdf Templateroller

Good Lord Please Take Advantage Of Generous City Of Cincinnati Commercial Tax Abatements Finney Law Firm

Amberley Village Tax Resources Amberley Village

A First Look At Proposed Major Changes To Cincinnati S Commercial Tax Abatements Wvxu

Cincinnati Ohio 1915 Aerial View City Hospital Ebay

Hamilton County Auditor Sues City Of Cincinnati Over Remote Workers Earnings Tax Payments Youtube

Work From Home And Taxes Refunds For Some Taxpayers Losses For Cities

Tax Services The Village Of Indian Hill

Services Payments City Of Cincinnati

Is This City Policy A Snowball Driving People From Homes

Cincinnati Property Tax Breaks Seeking To Boost Housing Council Makes It Easier To Get Them Cincinnati Business Courier

Ohio Workers Sue Columbus Cincinnati Over Pandemic Commuter Tax

City Will Continue Rollback Policy For Property Taxes Cincinnati Business Courier