nh business tax calculator

New Hampshire Department of Revenue. The tax is assessed on income from conducting business activity within the state at the rate of 77 for taxable periods ending on or after December 31 2019.

![]()

1040 Income Tax Calculator Free Tax Return Estimator

The Business Profits Tax BPT was enacted in 1970.

. Use our interactive calculator below to gain a better understanding of how your business can maximize its support of local community projects through the CDFA Tax Credit Program. The business will owe New Hampshire business profits tax in the amount of 38000 76 of 500000. Was related to meals and.

New Hampshire Business Enterprise Tax and New Hampshire Business Profits Taxes are due at the same time your federal return is due. Organizations operating a unitary business must use combined reporting in filing their new hampshire business tax return. Please note savings and net cost are based on an individual business federal and state tax rate.

You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. Instead taxes are as follows. New hampshire does not charge an estate tax but the federal government does.

New Hampshire has a 0 statewide sales tax rate and does not allow local. The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such as wages paid cost of goods sold and other qualifying business expenses.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. 0 5 tax on interest and dividends Median household income. If you use Northwest Registered Agent as your New Hampshire registered agent youll have an online account to track your company in receive notification reminders to file your annual reports on time annual tax.

Business Enterprise Tax RSA 77-E. For taxable periods ending on or after December 31 2022 the BPT rate is reduced to 76. In this guide well cover the main business taxes required in New Hampshire including payroll self-employment and federal taxes.

That means they are due on the 15th of the 4th 6th 9th and 12th month. 300 bpt and the business enterprise. The New Hampshire corporate income tax is the business equivalent of the New Hampshire personal income tax and is based on a bracketed tax system.

For Taxable periods ending on or after December 31 2016 the BPT rate is reduced to 82. When you use the e-File system for the first time you will select the First. The business will also owe New Hampshire business enterprise tax in the amount of 1100 055.

Every 2022 combined rates mentioned above are the results of new hampshire state rate 0. For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors. New employers should use 27.

And remember to pay your state unemployment. Sales Tax Compliance Platform. Census Bureau Number of cities that have local income taxes.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. New Hampshire income tax rate.

Owners pay state income tax on any profits minus. For taxable periods ending on or after. You must pay the estimated taxes on the 15th of each of the four months of your fiscal year.

Now if 50 of those 75 in expenses was related to meals and. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. Our small business tax calculator is very accurate.

What is the Business Enterprise Tax BET For taxable periods ending before December 31 2016 a 075 tax is assessed on the enterprise value tax base which is the sum of all compensation paid or accrued interest paid or accrued and dividends paid by the business enterprise after special adjustments and apportionment. Looking for information on sales tax in New Hampshire. Up to 25 cash back For the 2022 tax year your sole proprietorship had New Hampshire income of 500000 and an enterprise value tax base of 200000.

E-File Help - Business Tax Help. The New Hampshire Business Profits Tax BPT rate went from 82 to 79 and the New Hampshire Business Enterprise Tax BET rate dropped from 072 to 0675. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to New Hampshire local counties cities and special taxation districts.

For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. The profits of an LLC arent taxed at the business level like C Corporations. Owners pay self-employment tax on business profits.

Cloud-based platform automates sales tax compliance for more than 20000 businesses. Organizations operating a unitary business must use combined reporting in filing their New Hampshire Business Tax return. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

43 rows To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Find our comprehensive sales tax guide for the state of New Hampshire here. If you have filed with New Hampshire Department of Revenue Administration after 1998 you can pay your Business Enterprise Tax BET and Business Profit Tax BPT estimate extension return amended return and tax notice payments.

Concord NH 03301. New Hampshire Paycheck Quick Facts. Actual savings and net cost will vary.

These tax cuts were a result of the state meeting revenue goals in 2017. Governor Sununu promises additional tax rate reductions for both of these taxes in 2020 and 2022. The Business Enterprise Tax the BET is an entity level tax imposed upon all business enterprises slightly different than business organizations for the BPT which carry on any business activity in New Hampshire including corporations limited liability companies partnerships sole.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. New hampshires income tax is. New hampshire is one of the few states with no statewide sales tax.

New Hampshire Sales Tax Calculator. The new hampshire tax calculator is updated for the 202122 tax year.

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Ifta Calculator Tax Software Cool Photos Tax

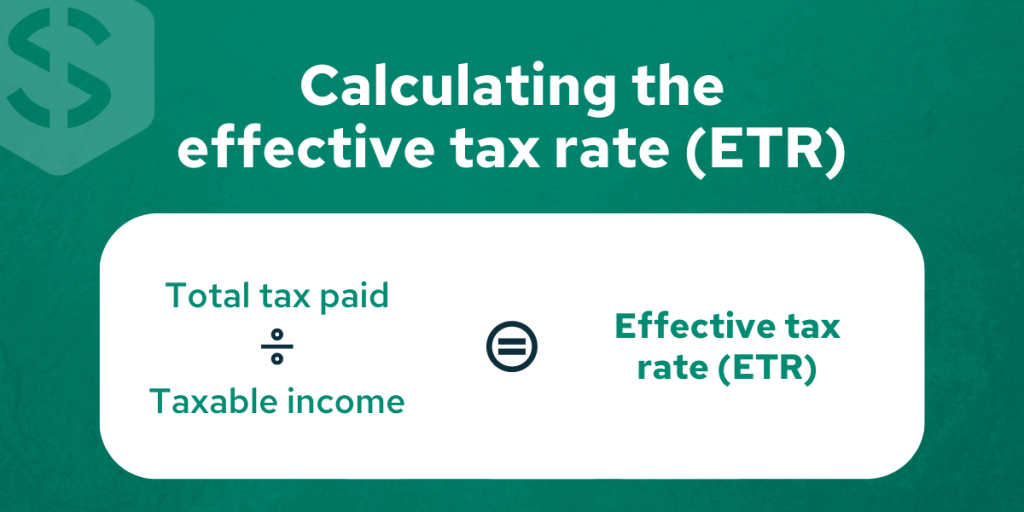

Effective Tax Rate 101 Calculations And State Rankings Savology

Self Employed Tax Calculator Business Tax Self Employment Employment

Llc Tax Calculator Definitive Small Business Tax Estimator

Elegant Cpa Certified Public Accountant Business Card Zazzle Com Certified Public Accountant Accounting Cpa

How Much Should I Set Aside For Taxes 1099

Pennsylvania Sales Tax Small Business Guide Truic

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Choose A Home Care Agency Payroll Tax Saving Investment Payroll Taxes

Quarterly Tax Calculator Calculate Estimated Taxes

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Llc Tax Calculator Definitive Small Business Tax Estimator

New York Sales Tax Calculator Reverse Sales Dremployee

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Personal Finance

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free